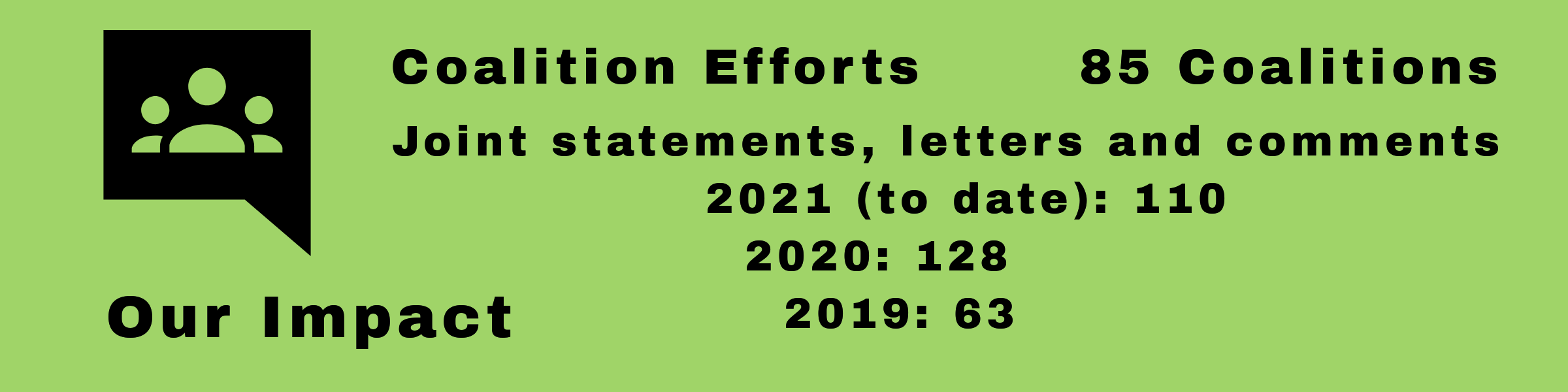

Coalition Efforts

Consumer Action is working on these important issues along with other organizations. If you would like to know more about these issues, please see “More Information” at the end of each article.

Table of Contents

Postings

Advocates support review of Federal Home Loan Banks mission

The Coalition for Federal Home Loan Bank Reform and dozens of other advocacy organizations submitted a letter to the Federal Housing Finance Authority urging reforms to the Federal Home Loans Banks mission statement.

Coalition supports the Stop Corporate Capture Act

The Coalition for Sensible Safeguards wrote to House leadership to express strong support for the Stop Corporate Capture Act (HR 1507), which would codify Chevron deference into law and protect regulatory agencies’ ability to protect the public.

Consumer Action endorses National Tenants Bill of Rights

Consumer Action gave its endorsement to a proposed National Tenants Bill of Rights, which would correct the power imbalance between tenants and landlords.

Support for legislation to lower prescription prices for U.S. consumers

Consumer Action expressed support for legislation that would amend the Federal Food, Drug, and Cosmetic Act to allow American wholesalers, pharmacies and individuals to import affordable and safe drugs from Canada, the United Kingdom, the European Union, and Switzerland as a way to make prescriptions more affordable.

97 organizations sign letter opposing House Majority’s FY25 spending proposal

Nearly a hundred organizations voiced their opposition to the House Majority’s FY25 spending proposal, which would make drastic cuts to the IRS and block implementation of the new Direct File program, which provides a free tax filing option for eligible taxpayers.

Organizations comment on proposals to reform the bank merger process

Consumer Action added its name to comments to the OCC and FDIC regarding regulatory proposals to reform the bank merger process, which the organizations contend are strongly biased in favor of merger approval, with little consideration for how communities are impacted.

Advocates push for adoption of permanent Direct File option for tax filers

More than 250 organizations and entities voiced their support for making Direct File—a free, accessible online tax filing system piloted during the 2024 tax season—a permanent option for eligible filers.

Request for a seven-month extension of VA foreclosure pause

Nearly three dozen consumer and housing advocacy organizations signed on to a letter to the Department of Veterans Affairs (VA) urging the agency to extend the foreclosure pause of VA-guaranteed loans from May 31, 2024, to December 31, 2024.

Organizations welcome FAA reauthorization agreement, but advocate for improvements

Consumer Action lent its voice to a public statement supporting the bill to reauthorize the Federal Aviation Administration (FAA), while also urging senators to support additional amendments that would provide crucial airline passenger rights and protections.

Strong support for FTC’s CARS—Combating Auto Retail Scams—Rule

More than a hundred groups signed on to a letter to Congress members asking them to support implementation of the Federal Trade Commission’s CARS Rule, which would combat unfair and deceptive auto dealer practices.