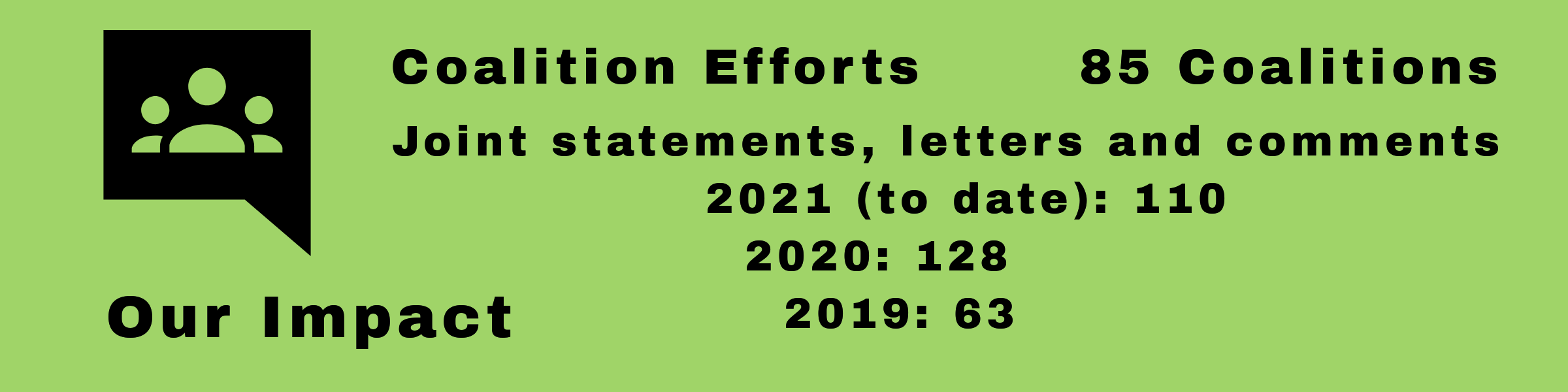

Coalition Efforts

Consumer Action is working on these important issues along with other organizations. If you would like to know more about these issues, please see “More Information” at the end of each article.

Table of Contents

Postings

Advocates push for adoption of permanent Direct File option for tax filers

More than 250 organizations and entities voiced their support for making Direct File—a free, accessible online tax filing system piloted during the 2024 tax season—a permanent option for eligible filers.

Request for a seven-month extension of VA foreclosure pause

Nearly three dozen consumer and housing advocacy organizations signed on to a letter to the Department of Veterans Affairs (VA) urging the agency to extend the foreclosure pause of VA-guaranteed loans from May 31, 2024, to December 31, 2024.

Organizations welcome FAA reauthorization agreement, but advocate for improvements

Consumer Action lent its voice to a public statement supporting the bill to reauthorize the Federal Aviation Administration (FAA), while also urging senators to support additional amendments that would provide crucial airline passenger rights and protections.

Strong support for FTC’s CARS—Combating Auto Retail Scams—Rule

More than a hundred groups signed on to a letter to Congress members asking them to support implementation of the Federal Trade Commission’s CARS Rule, which would combat unfair and deceptive auto dealer practices.

Support for the Codifying SAVE Plan Act, benefiting student loan borrowers

Consumer Action endorsed Senator Jeff Merkley (D-OR) and congressional allies’ Codifying SAVE Plan Act, proposed legislation that would codify President Biden’s new income-driven repayment program into law.

Advocates push for national registry to halt data broker abuse

Consumer Action was one of the initial supporters of an effort to prevail upon the FTC to create a national registry to halt data broker abuse.

CFPB rule would curb abusive overdraft fees

Nearly 150 groups signed on to a letter expressing strong support for the Consumer Financial Protection Bureau’s proposed rule governing overdraft fees charged by the largest financial institutions.

Legislation would curb abusive “trigger leads”—unwanted home financing offers to mortgage borrowers

Diverse groups signed on to letter supporting the Homebuyers Privacy Protection Act of 2024, which would curb the abusive use of mortgage credit “trigger leads”—the sale of consumer data that results in a bombardment of calls seeking to lure them from their chosen lenders.

52 advocacy groups endorse FTC’s ban on junk fees

Consumer Action was part of a broad coalition of advocacy organizations that voiced support for the FTC’s proposed rulemaking on junk fees, which would ban hidden and misleading fees across the economy.

FHFA should require new homes financed with Fannie/Freddie-backed mortgages to meet energy code requirements

More than 75 organizations urged the FHFA to require that all new homes purchased with mortgages backed by Fannie Mae and Freddie Mac meet updated energy code requirements.